Author: Mary Ann Marriott

I envy people who have no debt. I want to be like them. I really do. I have the skills, I have the desire, yet it seems like a goal floating in the wind. I can see it. And almost touch it but it keeps floating away from my grasp. Oh I’ve made some progress over the years, but unsteady income, child care and investments in my education have all ensured I don’t get too far away from debt. Not yet anyway. But I’m nothing if not persistent!

There is a disturbing trend happening in the Credit Counselling Industry. Companies are popping up online with toll free numbers, promises of reduced interest rates and manageable monthly payments.

Keeping track doesn’t have to be painful. You want to find a system that works for you, something not too complicated. You don’t have to track expenses for the rest of your life, but hopefully, you will realize the value, as I have, and want to make it part of your financial plan.

Financial institutions – banks, credit card companies, etc. have money. And they need to invest this money. And they need to make money on their investment. They do not loan us money because they like us, or we need it and our goals are important to them. (I am speaking from an institution perspective, your loans officer may care about you and your goals – the good ones anyway). They loan us money because they are investing in us

We seem to have this notion that we entered into a “till death do us part” commitment when we opened that new credit account with the bank. The reality is, we entered into a somewhat superficial relationship. I’m not knocking the banks. They provide a specific service to a specific target market. And they do it well. That’s why they are reporting increased profits on a regular basis. What I am saying, is you need to accept that this is a relationship that will serve you well if you don’t hit any major roadblocks along the way.

A retired couple, who came to me for financial advice, were in for one of their follow up Counselling Sessions. I had them track their spending for the previous month and was asking them how they did. They felt they had done a good job except for the fact that (in her words) her husband did not get receipts. He was openly frustrated with this requirement to account for every cent spent.

Is anyone really happy with the amount of income they’re making? I think we all feel that we deserve to have more, we deserve to spend more, we deserve to have less stress worrying...

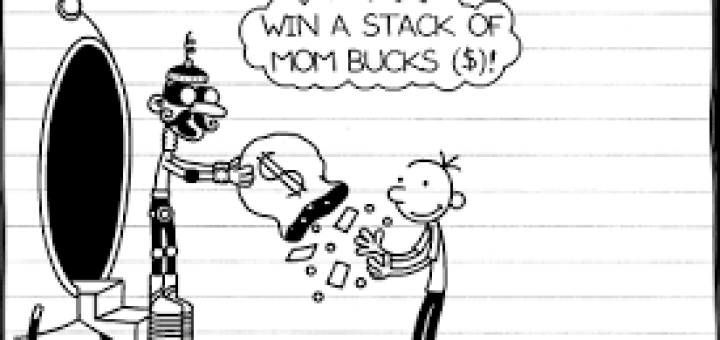

When my kids first started bringing the books home, I wasn’t crazy about the “wimpy kid”. He seemed a bit, well, jilted and rude. But the wimpy kid stayed around, the books came home from the library and the movie appeared several times at different events. And then, something magical happened

I always preface a discussion around the credit reporting system by stating how frstrating the system can be. In some ways it is very black and white, yet in others very grey. It is worth knowing the basics about what is on your report, how to check it and how to resolve issues.

The issue of cancelling credit cards that you are not using (or should not be using) is a complicated one. There are advantages and disadvantages depending upon your current financial situation and your future credit goals.